Matched betting is the perfect side hustle if you’re looking to save up for a house deposit. The concern many people have though is does it affect their chances of getting a mortgage?

The short answer is no, it won’t affect your chances at all, provided you’re careful and bear a few things in mind.

In this guide, I’ll explain what mortgage lenders are looking for and offer my advice on how best to prepare ahead of submitting your application.

Are matched betting profits ‘income’?

Although matched betting profits are 100% tax-free and yours to keep, they can’t be classed as income when applying for a mortgage. Your suitability for a mortgage will be based on your salary or wage from regular employment.

You can put your matched betting profits towards your house deposit though, that’s not a problem.

What do mortgage lenders look for?

Mortgage lenders need to be sure that you have the means to pay the loan back over the agreed length of term. If they don’t think you’re earning enough, your mortgage application will be declined.

We know matched betting is completely risk-free, but lenders won’t be interested. Any kind of betting activity will be seen as gambling, which portrays a high level of risk. They would much rather see a consistent flow of income from a regular job.

How do you keep your matched betting separate?

Different mortgage lenders have different processes. You should expect them to want to see three months of payslips and up to six months of bank statements.

My recommendation is to use a separate bank account for your matched betting. It’s what I’ve always done and I’ve never had any issues. When you’re ready to apply for a mortgage, you simply provide the statements for your main account, which should be clear of any betting activity. Keeping your matched betting separate like this will also help you keep track of your funds.

If you’d rather not open a separate bank account, you could opt for an e-Wallet or prepaid card. With some bookmakers though, these payment methods may exclude you from promotions or involve fees, so be sure to check the terms.

What other options are there?

Setting up a separate bank account really is the best option here, but if you’d rather not, you do have a couple of other options.

Your first option is to do matched betting without making any deposits or withdrawals. It’s not ideal, but you could just continue matched betting with whatever funds you have in your accounts. You should be okay to top up your exchange accounts when required. An odd transaction here and there shouldn’t present any issues.

The second option is to take a break from matched betting altogether until you’ve been approved for a mortgage. Matched betting is easy to dip in and out of so you shouldn’t have any issues picking up where you left off.

Does matched betting affect your credit rating?

If you’re planning to apply for a loan or mortgage, you might be concerned that matched betting will have a negative impact on your credit rating. You don’t need to worry about this.

Bookmakers are required by law to verify the age, location and residential status of customers. They can do this by performing a ‘soft credit check’. These checks are basically to confirm that you are who you say you are. They need to check that you’re not using the bookmaker for money-laundering purposes.

These checks are not for the purposes of lending you credit, so they don’t affect your credit score in any way.

Can professional gamblers get mortgages?

Things can be trickier for professional gamblers as earnings can fluctuate wildly from month to month. Poker, blackjack and matched betting are some of the more accepted forms of professional gambling when it comes to applying for a mortgage.

If they can provide a solid track record of consistent long-term profits, there’s no reason why they shouldn’t be able to get a mortgage. They may have to pay a higher rate of interest, but that’s probably a price worth paying. If things are going well for them, they may be able to offset the higher interest rate with a larger deposit.

Final words

Matched betting won’t affect your chances of getting a mortgage. It’s actually a great way of earning some extra cash to put towards a house deposit.

If you haven’t already, you should definitely consider getting yourself a separate bank account for your matched betting activity. It will help with your application and make it easier to manage your bankroll.

If you have any questions or want to share your mortgage experience, please leave a message in the comments section below.

Happy house hunting!

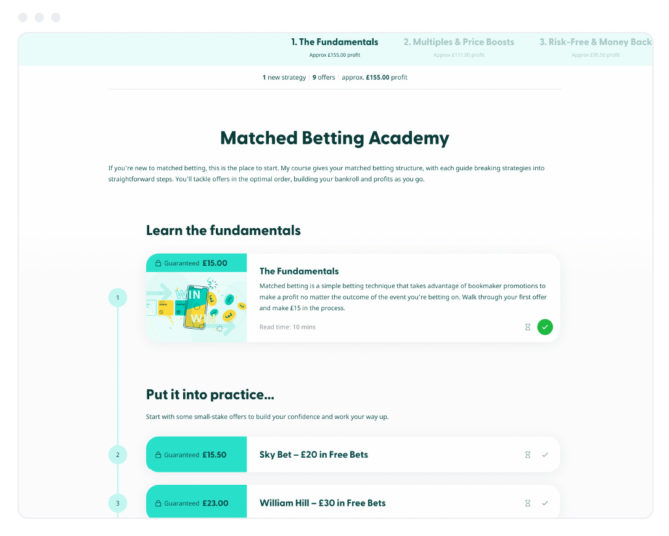

Learn matched betting the free, easy way.

The Matched Betting Academy

- Logically structured to tackle strategies and offers as you’re ready for them.

- Bag profits every step of the way. About £600 from welcome offers, and another £500 monthly.

- Make £15 from your very first offer.

Got a question?

Leave me a comment below…

I usually respond within 24 hours.

Matt Kirman – Matched Betting Blogger

Since 2014, I’ve blogged over £85,000 worth of profit, and made it my mission to make matched betting accessible to everyone.